Silver looks to have either completed or is near completion of this upward leg at 35.77. Yesterdays spinning top is flashing a warning that we may see a sharp reversal in the making. A daily close under the Sma 200 would signal that a near term top is in. -------- Well had it kind of right...as long as you don't count the blow-off top into the daily 61.8 fib.. daily closing under the 200 SMA puts Silver back on the defencive...

Tuesday 28 February 2012

Monday 27 February 2012

As mentioned in previous posts - Aud Crosses

Aud and Kiwi coming under continued pressure against the crosses forcing AudUsd n NzdUsd lower in early asian trade.. Yen longs continued to be squeezed.

Saturday 25 February 2012

EurCad

EurCad Daily chart is bullish but has stopped right at the pivotal 1.3435 level. I would expect a mild pullback early next week into the 38.2 fib and 89ema zone at 1.3370 then a further push toward the 50 and 61.8 fib retracements and Daily 200 Sma.

Only a daily close back below the 50 ema would complicate the immediate bullish scenario.

Only a daily close back below the 50 ema would complicate the immediate bullish scenario.

Cable

Whilst cable did accelerate lower from my initial top at 1.58795, we failed to reach our target zone around 1.5580/95.. only reaching the 100 fib at 1.56479...the sharp rebound higher on shorts unwinding looks to have caught a fair few punters off-guard today.

The 4 hourly chart is still in bullish mode although expect some profit taking at current levels where the new AB = CD would complete - 1.5885. Also on the radar is the key Daily 200 Sma a tad above us at 1.5905. 1.5905 has also been a pivotal level for cable over the last 5 months.

Daily -

4 Hourly -

The 4 hourly chart is still in bullish mode although expect some profit taking at current levels where the new AB = CD would complete - 1.5885. Also on the radar is the key Daily 200 Sma a tad above us at 1.5905. 1.5905 has also been a pivotal level for cable over the last 5 months.

Daily -

4 Hourly -

EurUsd - Previous update playing out

Now that resistance at 1.3346 was broken and closed above, upside milestones on the way to target remain the fib levels. Currently we have sped thru the 50.0 fib en route to the 61.8 at 1.36274.

Ideally the target of this current leg would be the AB = CD at 1.37109 , the zone inbetween the 61.8 and 70.7 fib retracement points after the previous lower leg finished inbetween the 141.4 and 161.8 fib extensions.

Also coming in around that level is the Daily 200 Sma.

Ideally the target of this current leg would be the AB = CD at 1.37109 , the zone inbetween the 61.8 and 70.7 fib retracement points after the previous lower leg finished inbetween the 141.4 and 161.8 fib extensions.

Also coming in around that level is the Daily 200 Sma.

EurChf - more of a gamble than trading lately

I dont really look at EurChf as far as trading goes nowadays due to the one obvious fact that at any moment it could go nuts in both directions for a few big figs then reverse the same all in a matter of minutes.... 25 yards of stops under 1.2000 and the SNB intervening... OK if your a Binary Options kind of person..but not for this cub.

But, for people who persist here is the current pattern unfolding.

Target - 1.2033 - AB = CD and a tad through the 161.8 fib extension as the retrace did not quite make it all the way to the 61.8.

But, for people who persist here is the current pattern unfolding.

Target - 1.2033 - AB = CD and a tad through the 161.8 fib extension as the retrace did not quite make it all the way to the 61.8.

Case For Aud Topping ?

Given the current massive unwind of Eur and to a lesser extent Gbp shorts and Yen longs, the Aud seems particularly vulnerable at least in the short term on the crosses and hence will probably struggle against the USD as well.

EurAud has now cleanly taken out the daily 50 ema and the 23.6 fib res at 1.2527. Obvious next port of call would be the 38.2 at 1.2771.

GbpAud whilst still inside the recent sideways to lower channel trade bounded by 1.4841 then the 50 ema at 1.4918. This current drive higher looks to be gaining legs.

The 4 hourly chart confirms the notion with a clear AB = CD pattern unfolding confirmed with the fib confluence of a 70.7 - 141.4 retrace and extension to the target zone at 1.4945.

To confirm lastly we can see that AudCad is also forming an AB = CD pattern on the 4 hourly time frame

where AB leg - 1.0750 to 1.0596 retraced to the 78.6 Fib thus ideally the fib target would be the 127.2 extension from point C at 1.0719 to target 1.0563.

AB = CD comes in at 1.0566

EurAud has now cleanly taken out the daily 50 ema and the 23.6 fib res at 1.2527. Obvious next port of call would be the 38.2 at 1.2771.

GbpAud whilst still inside the recent sideways to lower channel trade bounded by 1.4841 then the 50 ema at 1.4918. This current drive higher looks to be gaining legs.

The 4 hourly chart confirms the notion with a clear AB = CD pattern unfolding confirmed with the fib confluence of a 70.7 - 141.4 retrace and extension to the target zone at 1.4945.

To confirm lastly we can see that AudCad is also forming an AB = CD pattern on the 4 hourly time frame

where AB leg - 1.0750 to 1.0596 retraced to the 78.6 Fib thus ideally the fib target would be the 127.2 extension from point C at 1.0719 to target 1.0563.

AB = CD comes in at 1.0566

On the other hand...

Both Eur and Gbp Yen Cross pairs are through their respective target zones at EurJpy - 107.84 to 108.45 and GbpJpy - 127.61 the AB = CD.

Daily AudJpy into target zone

AudJpy coming into view of daily target zone at 86.45/86.68

86.45 - 127.2 Fib extension after the 78.6 retrace ( 83.95 - 74.77)

86.88 - AB = CD , where AB was 72.04 to 83.95

86.45 - 127.2 Fib extension after the 78.6 retrace ( 83.95 - 74.77)

86.88 - AB = CD , where AB was 72.04 to 83.95

Friday 24 February 2012

EurJpy

Finally makes it to the target zone bounded by the AB = CD target at 107.835 and the 78.6 retrace at 108.45...

3 Aud Banks get Fitchslapped

NAB, Westpac and good ol'" Which Bank ? " - CBA.

Affirms ANZ on funding concerns and vulnerability to market swings..

Aud n crosses dropping off a tad.

Affirms ANZ on funding concerns and vulnerability to market swings..

Aud n crosses dropping off a tad.

Loonie - UsdCad

4Hrly UsdCad completed perfectly at the 78.6 fib and prior AB = CD at 1.0019. Curently it looks as though a new pattern is emerging with downside target at the 127.2 Fib extension which coincides with the AB = CD target at 0.9875.

April Crude - CLJ2

Still no signs of exhaustion with today's strong advance through the 4 hourly fib extension and target zone. Looking at the weekly and daily charts both remain bullish with a number of objectives possible.

From a weekly technical perspective, clearing and a weekly close above the 61.8 retracement at 103.83 of the 147.26 - 33.56 2008/2009 collapse would have us looking at the next fib targets of 113.95 - 70.7%, 122.93 - 78.6, and 134.30 - 88.6. with the obvious favourite of 114.80 - Last years high.

Moving down a notch to the Daily chart another possible target area may be unfolding of an AB = CD target at 120.91 which comes in close to the 113.0 fib extension at 119.98. But Gartley practitioners would not agree with that scenario as BC was only a 38.2 retracement of the AB leg.

From a macro perspective the obvious tensions with Iran and better (kinda...) data coming both from Europe and the US has contributed to the case for higher crude prices as has a general slide in the USD. On the flipside though, I really wonder just how long it will be before we see the US Government (Already in full re-elect Obama mode... Do you really believe the recent NFP ??) begin to release its ever growing SPR - http://www.spr.doe.gov/ stockpiles to dampen any negative side effects on both the flailing recovery in the US and the re-election of President Obama.

One last piece to the puzzle is shown in the COT data which shows that currently we are at 5 year record levels with Swaps at 5 year highest short positions and Producers/Users at 5 year smallest short positions.

Whilst this trend remains strong I do not urge trying to pick a top,but I do urge caution on late longs joining the party.

From a weekly technical perspective, clearing and a weekly close above the 61.8 retracement at 103.83 of the 147.26 - 33.56 2008/2009 collapse would have us looking at the next fib targets of 113.95 - 70.7%, 122.93 - 78.6, and 134.30 - 88.6. with the obvious favourite of 114.80 - Last years high.

Moving down a notch to the Daily chart another possible target area may be unfolding of an AB = CD target at 120.91 which comes in close to the 113.0 fib extension at 119.98. But Gartley practitioners would not agree with that scenario as BC was only a 38.2 retracement of the AB leg.

From a macro perspective the obvious tensions with Iran and better (kinda...) data coming both from Europe and the US has contributed to the case for higher crude prices as has a general slide in the USD. On the flipside though, I really wonder just how long it will be before we see the US Government (Already in full re-elect Obama mode... Do you really believe the recent NFP ??) begin to release its ever growing SPR - http://www.spr.doe.gov/ stockpiles to dampen any negative side effects on both the flailing recovery in the US and the re-election of President Obama.

One last piece to the puzzle is shown in the COT data which shows that currently we are at 5 year record levels with Swaps at 5 year highest short positions and Producers/Users at 5 year smallest short positions.

Whilst this trend remains strong I do not urge trying to pick a top,but I do urge caution on late longs joining the party.

Gold + Silver

Spot Gold still hovering just under the 1800 Option area with very little action going on overnight considering the strong anti-USD moves seen across the board.

Daily Chart remains bullish with the previously mentioned target area of 1792.55 - 1802.54 attracting price.

At this point only a break and close under the daily 26 ema should generate further retracement toward the 200 Sma and 50% Fib area.

Spot Silver - Overnight saw a strong move higher out of the sideways consolidation zone and through the Daily 200 Sma. Similarly to Gold the ideal target of this move would be the 100.0 % Fib at 35.66 to the AB=CD target at 35.77.

Charts remain in a bullish mode and further gains may well be see on a strong close above the 100 fib. At this stage only a failure at target and subsequent break and close under the 26 Ema would have us looking at a retracement toward the 50% Fib at 30.90.

Daily Chart remains bullish with the previously mentioned target area of 1792.55 - 1802.54 attracting price.

At this point only a break and close under the daily 26 ema should generate further retracement toward the 200 Sma and 50% Fib area.

Spot Silver - Overnight saw a strong move higher out of the sideways consolidation zone and through the Daily 200 Sma. Similarly to Gold the ideal target of this move would be the 100.0 % Fib at 35.66 to the AB=CD target at 35.77.

Charts remain in a bullish mode and further gains may well be see on a strong close above the 100 fib. At this stage only a failure at target and subsequent break and close under the 26 Ema would have us looking at a retracement toward the 50% Fib at 30.90.

Thursday 23 February 2012

EurCad

Watch for a top.

Target at the AB = CD 1.3282 and the 113.0 Fib extension from the 88.6 AB retracement at 1.3288 achieved. Charts remain bullish but will be watching for a short setup.

Target at the AB = CD 1.3282 and the 113.0 Fib extension from the 88.6 AB retracement at 1.3288 achieved. Charts remain bullish but will be watching for a short setup.

Spot Gold - XauUsd

Gold is creeping toward the target zone located in between 1793.50 ( AB = CD) and 1802.50 ( 100.0% Fib retracement after a 100% retrace lower).

Given the large volume of 1800 expiries that are said to be rolling off tonight price should hover around that level until expiries are done.

As the chart looks very bullish I would be maintaining longs looking for an exhaustive run higher into 1839 first.

Given the large volume of 1800 expiries that are said to be rolling off tonight price should hover around that level until expiries are done.

As the chart looks very bullish I would be maintaining longs looking for an exhaustive run higher into 1839 first.

April Crude - CLJ2

April Crude has reached its daily AB = CD upside target at 106.65 forming a spinning top at yesterdays close. Whilst it is still a little too early to call a top this market should be watched closely here for either a drop confirming yesterdays candle or a further push into the 141.4 fib extension at 107.15 ( after the 70.7 retrace of the AB leg) where exhaustion should set in to produce a retracement.

UsdCad

Watching the Loonie with interest. The 4 hourly chart remains bullish although last nights high at 1.0019 should have completed this upward move as both the AB = CD and 78.6 fib retracement come in at that point.

Wednesday 22 February 2012

Cable

4 Hourly Cable is currently tracing out the CD leg of an AB = CD pattern ( AB - 1.5928 to 1.5644 ) from the C point at 1.59795 with the AB = CD target at 1.55965 with Fib confluence at 1.5580 - being both the 127.2 fib extension after a 78.6 retrace of the AB leg to point C and also the 50 fib of the XA leg ( 1.5233 - 1.5928 ).

Indicators are bearish and a break and failure under the 50 and 68 emas adds support to the move lower to the next level of support at 1.5734 which has been a pivotal area and also the 61.8 fib of the 1.5644 - 1.58795 BC leg then target area..

Indicators are bearish and a break and failure under the 50 and 68 emas adds support to the move lower to the next level of support at 1.5734 which has been a pivotal area and also the 61.8 fib of the 1.5644 - 1.58795 BC leg then target area..

Tuesday 21 February 2012

ESH2 - AB=CD Target met

The Initial target of the AB=CD has been met at 1368.25 with a Presidents Day shortened session closing the day with a spinning top. Overhead we still have the May 2011 previous high at 1372.5 and the 161.8 fib extension target at 1376.5 to have a crack at.

Whilst weekly charts are a little out of my league as far as trading goes, they remain very bullish and suggest targets @ 1455.25 ( 78.6//127.2 ext) then 1552 which would be the culmination of the current CD leg of the 665.50-1216.25 AB leg.

The current pull back on the hourly charts should ideally target the 1360 Sunday gap.

Whilst weekly charts are a little out of my league as far as trading goes, they remain very bullish and suggest targets @ 1455.25 ( 78.6//127.2 ext) then 1552 which would be the culmination of the current CD leg of the 665.50-1216.25 AB leg.

The current pull back on the hourly charts should ideally target the 1360 Sunday gap.

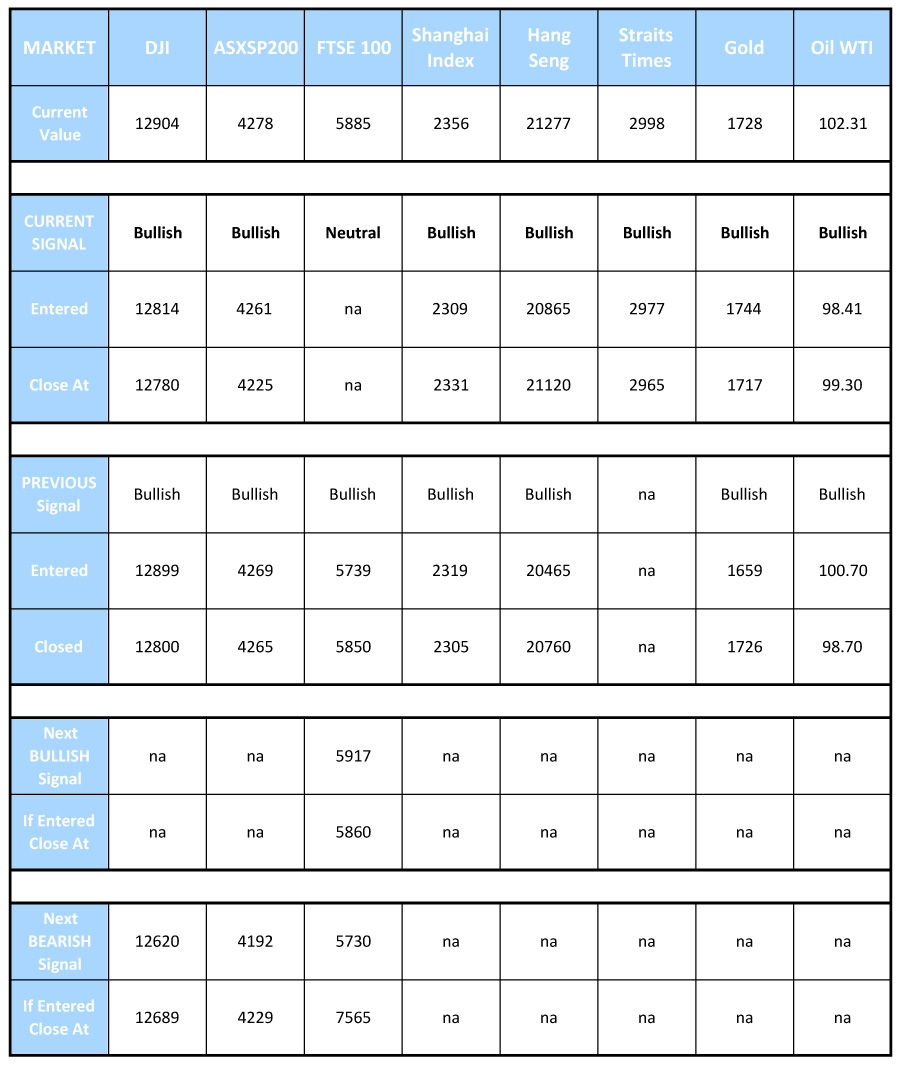

Short and Sweet: It’s a Bull Market !

21 February, 2012

Short and Sweet: It’s a Bull Market !

As expected progress continues to be made in the direction of a Greek resolution, even the European equity markets are starting to rally strongly, leaving no excuse for the US or Australian markets.

There is only upward acceleration at hand, and at bigger percentages than perhaps any of us expect.

Here is the picture in a nutshell:

Market sentiment has been “global recession” at best. Many feared worse.

Meanwhile actual price action has been steady gains for months, even with the overwhelming doom in the media.

What does this mean? There has been a real “need to buy” in some quarters, just to keep minimal stock portfolio levels in place, as the world has become increasingly awash with capital.

There is a tidal wave of global equity market investment coming that would dwarf even that of the movie 2012.

It is in fact 2012, the movie got it right, but its is a global flood of money that will catastrophically drive equity and commodity prices to all time historical records. In fact many stocks already are at all time historical highs, now watch the rest of the market do the same.

The favoured sectors remain Australian mining companies, and European fashion houses.

We have been buyers on the dip for all of the last two years, as well as having correctly heralded the start of a 5-15 year Grand Bull Market, just two days after the absolute low in 2009. So our long term clients are well set for this, but even if you have just joined us, it is not too late to do very well out of this Grand Bull Market. This next up wave, which is only just starting, will be the biggest of them all, quite possibly the largest and fastest rally stock markets have ever seen.

Do the math, record low levels of investment, a booming global economy, and enormous wealth and cash sitting in the hands of investors wondering what to do with it.

As expected progress continues to be made in the direction of a Greek resolution, even the European equity markets are starting to rally strongly, leaving no excuse for the US or Australian markets.

There is only upward acceleration at hand, and at bigger percentages than perhaps any of us expect.

Here is the picture in a nutshell:

Market sentiment has been “global recession” at best. Many feared worse.

Meanwhile actual price action has been steady gains for months, even with the overwhelming doom in the media.

What does this mean? There has been a real “need to buy” in some quarters, just to keep minimal stock portfolio levels in place, as the world has become increasingly awash with capital.

There is a tidal wave of global equity market investment coming that would dwarf even that of the movie 2012.

It is in fact 2012, the movie got it right, but its is a global flood of money that will catastrophically drive equity and commodity prices to all time historical records. In fact many stocks already are at all time historical highs, now watch the rest of the market do the same.

The favoured sectors remain Australian mining companies, and European fashion houses.

We have been buyers on the dip for all of the last two years, as well as having correctly heralded the start of a 5-15 year Grand Bull Market, just two days after the absolute low in 2009. So our long term clients are well set for this, but even if you have just joined us, it is not too late to do very well out of this Grand Bull Market. This next up wave, which is only just starting, will be the biggest of them all, quite possibly the largest and fastest rally stock markets have ever seen.

Do the math, record low levels of investment, a booming global economy, and enormous wealth and cash sitting in the hands of investors wondering what to do with it.

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au

Monday 20 February 2012

Of Course Markets Are Going Higher

20 February, 2012

Of Course Markets Are Going Higher

- China Reserve Requirements Cut

- Greek Deal in the Bag

- Gold Safe Haven Consolidation

China has cut the reserve ratio requirements for banks to 20.5%. Yes, that’s right the reserve requirement for banks in China is 20.5%. China continues to deliver the world’s best economic management, fine tuning a variety of measures to as near as perfectly influence different sectors of the economy, sometimes in opposing directions. Yet they make it work, and work well.

If the US had 20% reserve ratio requirements there would not have been a sub-prime crisis, there would not have been a GFC, even with all the over supply construction. It just would not have happened. Compare that policy debacle, and that is what it was, with a strongly growing economy, increasingly and dominantly domestic demand driven, massive population shifts, and still once the authorities decided to, they have delivered property price stability across the nation, with overall economic growth still close to 9%. A fantastic achievement you would be hard pressed to find anywhere else in the world.

Equity markets, especially Australian resource stocks, will respond positively to this latest fine tuning by China.

Greek resolution is in the bag. Should any member of the union vote against this deal, they would be considered a pariah by the majority, and especially by France and Germany. That would be a far greater price to pay than the funds being requested for the rescue package.

As we have said all along, Europe is already stronger for the experience. It will be a closer and more responsible union, and go from strength to strength. Rather than just the resolution of a difficult period, this is the beginning of a new enlightenment, well at least fiscally! I know it sounds repetitive, but Europe will be, and most probably already is, the most fiscally responsible region in the world.

While some argue this will be a drag on economic growth, what the situation really does, is create a new beginning for the already healthy private sector, and a greater availability of capital available to that private sector. Think less public spending equals more productive investment.

While many talk of fear of recession, I see this as being the start of a new golden age in Europe.

Equity markets can only respond positively, and begin that faster rally I have been speaking of, as the Greek package is approved.

Gold is consolidating as more and more good news emerges around the world, just as forecast here in The White Crane Report, for exactly now, many months ago. It was always going to be mid Q1 when the positive data of Q4 would emerge and prove the bears wrong yet again, and so it is. In reaction to this good news, the economic bears, false gold bulls, and there have been some stand out laughable famous major league personalities of late, who have suggested buying gold as a hedge against inflation, recession, contagion, and all that other nonsense, are also being proven wrong.

This good news flow in the face of those who do not understand the contemporary world or economics, will see many who bought gold for all the wrong reasons of “fear”, starting to exit quickly before they lose as much money on their gold bet, as they have being short equities for the past six months. Yes, there will be some selling pressure about, and this will cause substantial consolidation, but it will not stop the rise of Gold.

It has always been argued here, and I was probably about the most accurate forecasters of Gold in 2011 with a target high of US$1,950 on this basis, that you should buy gold for the “good” reasons of strong economic growth and prosperity in the “new first world”, particularly in China and India. It is not difficult to understand why the gold price would rise when the two most populace nations in the world, with cultures that value gold even more highly than we in the west, are also the fastest growing economies in the world.

When you add to this higher industrial demand, and last but not least, increased central bank holdings by these same major economies. Then Gold is still going well beyond US$2,000, probably $2,600. Does it happen this year or next, probably next, but it will still deliver a strong return this year post some confused consolidation just now. Keep buying Gold on the dip, and for lots of good reasons.

Overall the global prosperity story is finally being seen for what it is, a reality.

Clifford Bennett

Market Directions will be available later today, apologies for any inconvenience.

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au

EurUsd

EurUsd - Immediate target would be the daily resistance line at 1.3336. A daily close above would bring into focus the fib retrace levels at 1.3436 - 50 % and 1.3627 - 61.8.

The ideal target of this move would be the AB = CD target at 1.3710 with the daily 200 sma above at 1.3748 currently.. Only a breach and close beneath the 23.6 fib at 1.3008 would have us looking to retest the 1.2625 lows and signal a much deeper leg lower.

The ideal target of this move would be the AB = CD target at 1.3710 with the daily 200 sma above at 1.3748 currently.. Only a breach and close beneath the 23.6 fib at 1.3008 would have us looking to retest the 1.2625 lows and signal a much deeper leg lower.

Yens - Daily Perspective

UsdJpy - Target is 80.03 which would complete at the 113.0 ( after 88.6 retrace to 76.02 low) also the AB = CD of the intervention spike.

AudJpy - Still maintain the upward target zone at 86.45 - 127.2 Fib ext. ( after the 78.6 retrace to 74.77 ) and 86.81 which is the AB = BC target.

EurJpy - Whilst not as clear as the UsdJpy and AudJpy the AB = CD leg looks to complete at 107.83 between the 70.7 and 78.6 fib retrace levels. The 200 sma comes in at 107.28.

GbpJpy - Has smashed through both the daily 200 sma and my in initial target zone at 124.22 which now focuses on the longer perspective. The next objective would be the AB = CD at 127.58 where the AB leg is the 117.27 - 127.30 October 2011 rally. which as far as the fibs go brings us inline with a full 100 % retracement and extension.

AudJpy - Still maintain the upward target zone at 86.45 - 127.2 Fib ext. ( after the 78.6 retrace to 74.77 ) and 86.81 which is the AB = BC target.

EurJpy - Whilst not as clear as the UsdJpy and AudJpy the AB = CD leg looks to complete at 107.83 between the 70.7 and 78.6 fib retrace levels. The 200 sma comes in at 107.28.

GbpJpy - Has smashed through both the daily 200 sma and my in initial target zone at 124.22 which now focuses on the longer perspective. The next objective would be the AB = CD at 127.58 where the AB leg is the 117.27 - 127.30 October 2011 rally. which as far as the fibs go brings us inline with a full 100 % retracement and extension.

Friday 17 February 2012

Great Recovery as Expected for Euro and Australian Dollar

Clifford Bennett

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au

Got exactly the scenario we outlined for the Euro of “short term pain, followed by long term gain”. Well, we have yet to see the long term gain from here, but we may well be in day one of a substantial bull market.

Our Euro support at 1.2980 remained intact, and now we have this very strong first impulse wave to the upside. While several days consolidation in the range could be expected before the favoured break to the upside, it is important to note that the dominant risk is now at all times to the upside.

The fundamental argument for a significant Euro rally for the rest of the year could not be better. Europe has dealt effectively with the sovereign debt challenge, will have the most fiscally responsible economies in the world over the next 1-3 decades, and continues to experience rampant demand for its good s and services from Asia and Latin America, as well as the forecast pick up in economic activity in the US. All this and the market had been bearish? So the catch up to the far better reality than the consensus had forecast, is likely to see rapid price gains.

The US dollar will continue to trend lower. Remember the “strong dollar policy” is in fact, the “orderly decline of the US dollar policy”. Also the reason for the as forecast strong state of the US economy at this time is the rest of world demand for American goods and services, particularly out of Asia and Latin America. Asia and Latin America lead the global economic cycle and have done so for many years.

While some will begin to suggest that the US is now leading the world out of global recession risk, (you should never read anyone who says this ever again by the way, as it confirms they have no idea), the truth is the US economy will and can only remain strong if the dollar continues to move lower to a level that more accurately reflects its true worth in the world, on a par with the Euro and the Yuan once it freely floats. So despite economic well being returning to the US, the US dollar is expected to remain under significant pressure, as greater wealth is created elsewhere in the world and global portfolios continue to be re-weighted away from the US dollar.

The Australian dollar can only go from strength to strength in an environment of stable and high yield, not to mention the burgeoning resources boom, still in its early stages and with another 5- 15, perhaps 30, years to run.

Keep buying both the Euro and Australian dollar, against a US dollar still in long term decline.

Clifford Bennett

Our Euro support at 1.2980 remained intact, and now we have this very strong first impulse wave to the upside. While several days consolidation in the range could be expected before the favoured break to the upside, it is important to note that the dominant risk is now at all times to the upside.

The fundamental argument for a significant Euro rally for the rest of the year could not be better. Europe has dealt effectively with the sovereign debt challenge, will have the most fiscally responsible economies in the world over the next 1-3 decades, and continues to experience rampant demand for its good s and services from Asia and Latin America, as well as the forecast pick up in economic activity in the US. All this and the market had been bearish? So the catch up to the far better reality than the consensus had forecast, is likely to see rapid price gains.

The US dollar will continue to trend lower. Remember the “strong dollar policy” is in fact, the “orderly decline of the US dollar policy”. Also the reason for the as forecast strong state of the US economy at this time is the rest of world demand for American goods and services, particularly out of Asia and Latin America. Asia and Latin America lead the global economic cycle and have done so for many years.

While some will begin to suggest that the US is now leading the world out of global recession risk, (you should never read anyone who says this ever again by the way, as it confirms they have no idea), the truth is the US economy will and can only remain strong if the dollar continues to move lower to a level that more accurately reflects its true worth in the world, on a par with the Euro and the Yuan once it freely floats. So despite economic well being returning to the US, the US dollar is expected to remain under significant pressure, as greater wealth is created elsewhere in the world and global portfolios continue to be re-weighted away from the US dollar.

The Australian dollar can only go from strength to strength in an environment of stable and high yield, not to mention the burgeoning resources boom, still in its early stages and with another 5- 15, perhaps 30, years to run.

Keep buying both the Euro and Australian dollar, against a US dollar still in long term decline.

Clifford Bennett

Clifford Bennett

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au

Yen Crosses - Daily chart targets

GbpJpy has completed the required move to 124.32/50 target zone

AudJpy - Daily target is coming into view at 86.45/81

EurJpy - Initial area of 103.90/104.30 then higher toward 107.30/65

AudJpy - Daily target is coming into view at 86.45/81

EurJpy - Initial area of 103.90/104.30 then higher toward 107.30/65

The Bullish White Crane View of the World is taking hold!

The Bullish White Crane View of the World is taking hold!

The media in general, and especially those individual economists, researchers, and strategists, who scared investors away, and put fresh business investment on hold the world over, are irrefutably wrong, and have a great deal to answer for.

There was never any justification for the absurd forecasts of doom made by these people. They will fall back on “America is saving the day” now, but it is the reverse that is true. The world has rescued the US and Europe. Robust aggressive economic growth and prosperity throughout the “new first world” of Asia and Latin America continues to drive ever greater demand for European and US goods and services.

Furthermore Main Street USA is truly over all this negative hype and has gone back to work and business as well. Even in Europe corporate profits have been fantastic, and private balance sheets are strong. The real economy, the real people of the world, have been back at work for a long time, leaving the world’s ivory tower economic pessimists in their wake.

I am not making these points to have a go at these people, as much as they deserve it for the very real anguish they have caused. If you are an out of work stock broker, banker, Australian manufacturing worker, or a property developer that the banks now endlessly say no to, then you should be intensely aware it is because of the poor level of real world economic understanding among the ivory tower economists of the world, and that many individuals in the media, who have focussed on and pushed such a one sided and totally wrong story for the past two years.

They simply do not get that the US and Europe, now come second to Asia and Latin America, in the global economic cycle.

Until they figure this out, something I have identified and been arguing since early 2009 they will continue to hype up any negative event or piece of data, but it just won’t work anymore. Even the investment community is beginning to move on from these people. Which is going to create quite a rally.

As I started to say above,, there is actually a constructive reason for this critique of many of the main economists and commentators in the west: if you continue to listen to them, you will continue to miss out on this, our, your, Grand Bull Market opportunity!

What you will increasingly hear is that the US has turned the corner, and therefore there is hope for the rest of the world, but Europe is still a concern. Such analysis will temper your investment strategy, and that is the last thing you need you right now. As I have been saying for many months, including getting wrong for a while mid last year admittedly, is that you need to aggressively buy all the companies you ever want to own. The prices we have seen recently, will never be seen again in our lifetime. The pessimists are still wrong even as they move to neutral. The global economy is incredibly vibrant, and will be firing on all cylinders on all continents this year. Equity markets have to price out the recession they were obsessed with, that was never going to happen, and begin to correctly price in the strong economic reality.

We have already started the biggest bull market in history, and the risk is it starts to move faster than any of us can imagine!

My Dow Jones Index target for 2-3 years set in early 2009, remains 19,000.

Our AXSP200 target over the same period is 9,000.

The Australian dollar forecast remains risk to US$1.1700.

Don’t listen to the bears trying to cover their tracks with cautionary snow!

Keep buying, especially, Australian mining stocks, European fashion houses, and property!

Clifford Bennett

The media in general, and especially those individual economists, researchers, and strategists, who scared investors away, and put fresh business investment on hold the world over, are irrefutably wrong, and have a great deal to answer for.

There was never any justification for the absurd forecasts of doom made by these people. They will fall back on “America is saving the day” now, but it is the reverse that is true. The world has rescued the US and Europe. Robust aggressive economic growth and prosperity throughout the “new first world” of Asia and Latin America continues to drive ever greater demand for European and US goods and services.

Furthermore Main Street USA is truly over all this negative hype and has gone back to work and business as well. Even in Europe corporate profits have been fantastic, and private balance sheets are strong. The real economy, the real people of the world, have been back at work for a long time, leaving the world’s ivory tower economic pessimists in their wake.

I am not making these points to have a go at these people, as much as they deserve it for the very real anguish they have caused. If you are an out of work stock broker, banker, Australian manufacturing worker, or a property developer that the banks now endlessly say no to, then you should be intensely aware it is because of the poor level of real world economic understanding among the ivory tower economists of the world, and that many individuals in the media, who have focussed on and pushed such a one sided and totally wrong story for the past two years.

They simply do not get that the US and Europe, now come second to Asia and Latin America, in the global economic cycle.

Until they figure this out, something I have identified and been arguing since early 2009 they will continue to hype up any negative event or piece of data, but it just won’t work anymore. Even the investment community is beginning to move on from these people. Which is going to create quite a rally.

As I started to say above,, there is actually a constructive reason for this critique of many of the main economists and commentators in the west: if you continue to listen to them, you will continue to miss out on this, our, your, Grand Bull Market opportunity!

What you will increasingly hear is that the US has turned the corner, and therefore there is hope for the rest of the world, but Europe is still a concern. Such analysis will temper your investment strategy, and that is the last thing you need you right now. As I have been saying for many months, including getting wrong for a while mid last year admittedly, is that you need to aggressively buy all the companies you ever want to own. The prices we have seen recently, will never be seen again in our lifetime. The pessimists are still wrong even as they move to neutral. The global economy is incredibly vibrant, and will be firing on all cylinders on all continents this year. Equity markets have to price out the recession they were obsessed with, that was never going to happen, and begin to correctly price in the strong economic reality.

We have already started the biggest bull market in history, and the risk is it starts to move faster than any of us can imagine!

My Dow Jones Index target for 2-3 years set in early 2009, remains 19,000.

Our AXSP200 target over the same period is 9,000.

The Australian dollar forecast remains risk to US$1.1700.

Don’t listen to the bears trying to cover their tracks with cautionary snow!

Keep buying, especially, Australian mining stocks, European fashion houses, and property!

Clifford Bennett

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au

Thursday 16 February 2012

Aud Jpy - firing short - watch

Cross and 60 min close under the 89 ema Hrly - 83.66 , would have a short signal firing. Initial stop -34 Pips. Move to B/E +37 Pips. Care on a bounce at the 61.8 fib @ 83.46 zone although I would only reverse on a full reversal signal and failure to break the 61.8 fib with an hourly close back above the 89 ema 60 min chart.

There is also a SHS present of sorts - Tgt would be almost a complete 100% Fib retrace of the 82.75 - 84.60 rally.

There is also a SHS present of sorts - Tgt would be almost a complete 100% Fib retrace of the 82.75 - 84.60 rally.

Trades - Hourly and 30 min TFs

Short Kiwi - 1/2 position @ 0.82843

Short EurJpy - 1/2 position 102.16

Aud and Kiwi crosses looking vulnerable in this move. Although I am dancing near the door as they are all relatively late entries after the drubbing overnight.

Watch AudCad for short, GbpAud for long entries

Short EurJpy - 1/2 position 102.16

Aud and Kiwi crosses looking vulnerable in this move. Although I am dancing near the door as they are all relatively late entries after the drubbing overnight.

Watch AudCad for short, GbpAud for long entries

Yen Crosses - Still more room higher ?

Daily charts still have some ways to go northward if they are to complete this current leg higher. Last nights action has taken the wind out of their sails and the Spinning Tops on the daily charts of UsdJpy, AudJpy and GbpJpy certainly give credibility to the retraces currently unfolding on the 4 Hourly charts.

The notion of these Yen crosses still moving higher on the Daily TF also fits with the view that the E-mini S+P futures also need to see this leg complete toward the 1368.25/1376.50 zone. Current pull-back may extend to as low as 1325 with minor support at the 89 ema @ 1332.50.

E-Mini S+P

AudJpy - Daily

EurJpy - Daily

GbpJpy - Daily

The notion of these Yen crosses still moving higher on the Daily TF also fits with the view that the E-mini S+P futures also need to see this leg complete toward the 1368.25/1376.50 zone. Current pull-back may extend to as low as 1325 with minor support at the 89 ema @ 1332.50.

E-Mini S+P

AudJpy - Daily

EurJpy - Daily

GbpJpy - Daily

Wednesday 15 February 2012

ES Daily

Triple top at 1352 completely smashed and hence the 4 Hourly SHS idea negated , has the daily chart back in front view .. The measured move of the AB=CD leg targets 1368.25 with the 161.8 Fib extension overhead at 1376.50 after the BC correction of a little over 61.8 % to 1147.25 in Nov 2011.

Aussie + Kiwi + ES

Couple of charts to keep an eye on -

Whilst the 1352.0 triple top remains unbroken, the Head and Shoulders pattern remains valid with the neckline at 1335.50 and the target zone of 1316.25 - 1318.25. Given the close correlation between the ES, Aussie and Kiwi it is worthwhile watching all three for these patterns to either playout together or completely take off to the topside.

AudUsd 4 hourly chart - Two possible necklines to choose from, same result - 1.0428

NzdUsd 4 Hourly chart - much cleaner setup. 0.8096 Target.

Whilst the 1352.0 triple top remains unbroken, the Head and Shoulders pattern remains valid with the neckline at 1335.50 and the target zone of 1316.25 - 1318.25. Given the close correlation between the ES, Aussie and Kiwi it is worthwhile watching all three for these patterns to either playout together or completely take off to the topside.

AudUsd 4 hourly chart - Two possible necklines to choose from, same result - 1.0428

NzdUsd 4 Hourly chart - much cleaner setup. 0.8096 Target.

..... Algos kill a good selloff yet again...

Trade the tape, market doesn't care what you think, feel or hope...

Mini S+P - ESH2

240 min chart has SHS lining up. Neckline comes in at 1335.25 with target at 1316.25 which also comes in near the 61.8 fib retrace - 1317.25 and the AB=CD at 1318.25.

Tuesday 14 February 2012

This looks like a fail...

Still long UsdCad and Short the ES... Have not had a chance to sit at the screen for any reasonable length of time to be more active.

Sorry, but although I know that the longer term will be fine - as can kicking has proven its worth and ratings agencies are about as timely as international mail in Chile... I cant get rid of this feeling that we are about to receive a nasty bear bite.. It wont be sweet but should be relatively quick.

I am waiting for the World Vision organisation to unfold an - Adopt A Greek Family - program any moment soon..

Short term traders - You should already be SHORT Risk..

Long term traders- ( The Ones who use longer stops or block trade - Buy weakness..)

As for CL.... trade what you see... Still think it goes higher then has one almighty 2008 style dump

Sorry, but although I know that the longer term will be fine - as can kicking has proven its worth and ratings agencies are about as timely as international mail in Chile... I cant get rid of this feeling that we are about to receive a nasty bear bite.. It wont be sweet but should be relatively quick.

I am waiting for the World Vision organisation to unfold an - Adopt A Greek Family - program any moment soon..

Short term traders - You should already be SHORT Risk..

Long term traders- ( The Ones who use longer stops or block trade - Buy weakness..)

As for CL.... trade what you see... Still think it goes higher then has one almighty 2008 style dump

Saturday 11 February 2012

Friday 10 February 2012

Aud coming under pressure

Position adjustment time in Asia by the looks of it with Aud leading the pack

A tad busy on the FxMax project

There have been a few ops come and go, but I have been busy helping a good friend get a new project up and running which has not left much time to dedicate to the screens.

On the macro front things seem to be looking a tad brighter as far as the data goes and everywhere else for that matter unless you happen to be a Greek civil servant or poli... Just goes to show that if you kick the can down the road long enough and throw enough cash at the problem it will go away.... well.. the market might forget about it for a spell.

By the look of it the Nasdaq is leading the pack higher as per normal and is well on its way to test the 161.8 % Fib @ 2576.96.

March ES mini contract - ESH2 currently finding some resistance at the Daily 141.4 % Fib. Ideally, the Daily chart suggests that the upside target for this leg would be in the vicinity of 1368.25 ( AB=CD) to 1376.50 ( 161.8 % Fib extension after a CD 61.8 retrace) zone.

March WTI Crude - CLH2, Daily chart has turned bullish with the target set in the 106.70 ( AB=CD) to 107.10 ( 141.4% Fib extension from the 70.7 pullback at 95.43) zone.

4 Hrly charts are suggesting we require a brief pullback or some consolidation at lower levels before the next assault higher towards target.

Currently we are in the 4 Hrly target zone of the up move at channel resistance and the 78.6% Fib. Whilst there looks to be further upward momentum I will be looking for signs on the lower time frames that this move is near an end and a retrace is underway. Confirmation would come on a 4 Hrly break and close under the 222 ema.

Spot Gold - XAUUSD, Is caught in a consolidation zone between 1698 and 1760. On a daily chart current price action does resemble that of the highs put in in Nov and Dec of 2011, although ideal target would be an attempt at previous highs close to 1800 . Daily close under the 11 ema would have me looking for a retracement back to the 50 and 200 day smas.

On the macro front things seem to be looking a tad brighter as far as the data goes and everywhere else for that matter unless you happen to be a Greek civil servant or poli... Just goes to show that if you kick the can down the road long enough and throw enough cash at the problem it will go away.... well.. the market might forget about it for a spell.

By the look of it the Nasdaq is leading the pack higher as per normal and is well on its way to test the 161.8 % Fib @ 2576.96.

March ES mini contract - ESH2 currently finding some resistance at the Daily 141.4 % Fib. Ideally, the Daily chart suggests that the upside target for this leg would be in the vicinity of 1368.25 ( AB=CD) to 1376.50 ( 161.8 % Fib extension after a CD 61.8 retrace) zone.

March WTI Crude - CLH2, Daily chart has turned bullish with the target set in the 106.70 ( AB=CD) to 107.10 ( 141.4% Fib extension from the 70.7 pullback at 95.43) zone.

4 Hrly charts are suggesting we require a brief pullback or some consolidation at lower levels before the next assault higher towards target.

Currently we are in the 4 Hrly target zone of the up move at channel resistance and the 78.6% Fib. Whilst there looks to be further upward momentum I will be looking for signs on the lower time frames that this move is near an end and a retrace is underway. Confirmation would come on a 4 Hrly break and close under the 222 ema.

Spot Gold - XAUUSD, Is caught in a consolidation zone between 1698 and 1760. On a daily chart current price action does resemble that of the highs put in in Nov and Dec of 2011, although ideal target would be an attempt at previous highs close to 1800 . Daily close under the 11 ema would have me looking for a retracement back to the 50 and 200 day smas.

Subscribe to:

Posts (Atom)